Here’s how this works…

Each week we’ll introduce you to one new investing term that you’ll need to know if you want to start investing.

Then we’ll provide a summary of the past week’s financial news and explain why it’s relevant to you as a beginner investor and, more importantly, how you can use this knowledge to your advantage.

So, let’s get cracking!

TERM TO LEARN

A BOND IS A FIXED-INCOME INSTRUMENT AND INVESTMENT PRODUCT WHERE INDIVIDUALS LEND MONEY TO A GOVERNMENT OR COMPANY AT A CERTAIN INTEREST RATE FOR AN AMOUNT OF TIME. THE ENTITY REPAYS THE PRINCIPAL (THE ORIGINAL VALUE) WITH INTEREST WHEN THE BOND MATURES:

The borrower promises to pay you back the full amount (called the principal) on a specific future date (the maturity date).

The borrower also agrees to pay you interest, usually at regular intervals, until the maturity date.

Bonds are considered a type of fixed-income investment because they provide a steady stream of income through interest payments.

INVESTMENT NEWS FOR BEGINNERS

Investment Update: Diversification pays off.

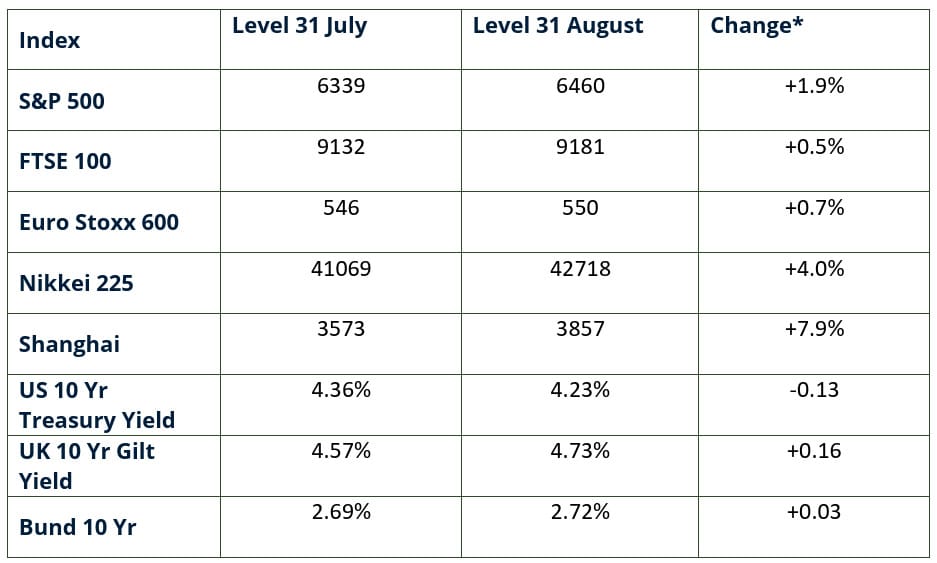

This month saw global equity markets mostly go up, with non-US regions like China, Japan, Asia Pacific, and Europe outperforming. UK government bond markets are struggling, but the FTSE 100 index did well due to its international reach. AI and tech stocks remain headline leaders, but global risks and politics continue to influence confidence.

Why this matters to you…

Diversification helps protect against downturns in any one market—global events can shake portfolios.

Following major index trends teaches beginners how different sectors perform.

What you need to do…

Spread investments across several regions and industries.

Keep learning about sector performance—AI and tech, notably, drive many market movements.

Concerned about inflation? Economists share the best investment strategies.

Inflation causes money to lose purchasing power, so saving cash without investing can reduce its value over time. Economists advise diversifying investments, using a mix of stocks (equities), government bonds designed to keep up with inflation, real estate investment trusts (REITs), and commodities like gold. Stocks, especially in sectors like energy, tend to outperform inflation in the long run by growing company earnings. However, no single investment fully protects against inflation, so a balanced portfolio is the best approach.

Why this matters to you…

Inflation can erode investment returns if not managed properly. So, knowing which assets typically do well during inflation helps protect and grow investments.

What you need to do…

Don’t keep too much cash during high inflation since it loses value over time.

Focus on sectors that historically do well in inflationary times, like energy and real estate.

Consider government bonds linked to inflation for stable but lower-risk exposure.

Use low-cost index funds or ETFs that cover a broad range of assets to achieve diversification.

Quantum computing is skyrocketing - Is this stock a ‘buy right now’?

Quantum computing, a cutting-edge technology promising to revolutionize fields like medicine, AI, and cryptography, is gaining huge investor interest. Stocks in companies involved in quantum computing—such as IBM, Alphabet (Google), IonQ, and Honeywell—have seen notable price rises recently as breakthroughs and partnerships bring the technology closer to commercial reality. Quantum computers use “qubits” to process enormous amounts of data quickly, far beyond what traditional computers can do. However, the field is still in the early stages, meaning quantum stocks can be very volatile with high risk, but also potential for big rewards.

Why this matters to you…

Quantum computing represents a major technological leap that could fuel future growth in tech and related industries.

Investing in quantum stocks offers an opportunity to participate in the next big innovation wave.

Awareness of emerging sectors helps investors diversify and choose investments aligned with future trends.

What you need to do…

Avoid putting too much money into single quantum stocks due to high volatility and uncertainty.

Consider investing through diversified funds or ETFs that include quantum computing and other tech stocks.

Use quantum computing as a small part of a balanced portfolio, not the core investment.

Be prepared for ups and downs and maintain a long-term investment outlook in emerging technologies.

ONE LAST THING...

Need a bit of inspiration?

Earl Crawley built a $500,000 stock portfolio through disciplined investing in dividend-paying, blue-chip stocks despite working for decades as a parking lot attendant earning low wages. He saved consistently, reinvested his dividends, and learned investing insights from financial professionals who visited his workplace. His story is an inspiring example of how patience, persistence, and smart money management can grow wealth over time, even with a modest income.

If Earl can do it, so can you!

Thanks for reading this third edition.

Is it just me, or did we cover quite a lot today?

You’ve earnt yourself a treat. Get yourself a biscuit / high five yourself / take tomorrow off - or whatever feels right.

Either way, we’ll be back next week. Will we see you then?