Here’s how this works…

Each week, we will introduce you to one new investing term that you’ll need to know if you want to start investing.

Then we’ll provide a summary of the past week’s financial news and explain why it’s relevant to you as a beginner investor and, more importantly, how you can use this knowledge to your advantage.

So, let’s get cracking!

TERM TO LEARN

A DIVIDEND IS A SLICE OF A COMPANY’S POST-TAX PROFITS THAT IS ‘DIVIDED UP’ AMONG SOME OR ALL OF ITS SHAREHOLDERS AS A REWARD FOR INVESTING IN THEM.

Definition and purpose:

A dividend is the amount of profit that a company returns to its shareholders.

It serves as a reward for shareholders and helps attract new investment.

Types and payment:

Dividends are usually paid in cash, but can sometimes be offered as additional shares of stock.

They are typically paid quarterly, though some companies may pay annually or on other schedules.

Dividend yield:

The dividend yield is a financial ratio that shows how much a company pays out in dividends relative to its stock price.

It’s calculated by dividing the total annual dividends by the share price and converting to a percentage.

Considerations for investors:

Not all companies pay dividends. Some, especially smaller or growth-focused companies, may reinvest profits instead.

Dividend-paying stocks can be attractive for income-seeking investors, particularly retirees.

Higher dividend yields may indicate higher risk, as struggling companies might raise dividends to attract investors.

INVESTMENT NEWS FOR BEGINNERS

BOJ is set to raise benchmark rates to its highest level since 1995.

Japan’s central bank (the BOJ) is expected to raise its main interest rate to about 0.75%, the highest level in roughly 30 years. This is happening because prices in Japan have been rising (inflation has been above the BOJ’s 2% target for more than three and a half years), and the weak yen has made imports like fuel and food more expensive. Markets are almost certain the BOJ will hike and may raise rates again later, but the BOJ is trying to move slowly so it does not shock the economy or push government borrowing costs up too fast.

Why this matters to you…

The BOJ is now likely to be the only major central bank hiking rates this year, at the same time as the US Federal Reserve is heading the other way, which is unusual and marks Japan as an “outlier”.

For beginner investors, this shows that not all countries are in the same place in the economic cycle. Central banks can be tightening in one country and easing in another, creating opportunities and risks in different markets.

What you need to do…

Interest rate decisions, like the BOJ’s move to 0.75%, can change the direction of bond yields, currencies and stock markets, even if the level of rates still looks low.

As a beginner investor, building a simple habit of checking major central bank decisions (US, Europe, Japan, UK) can help you understand big market moves rather than being surprised by them.

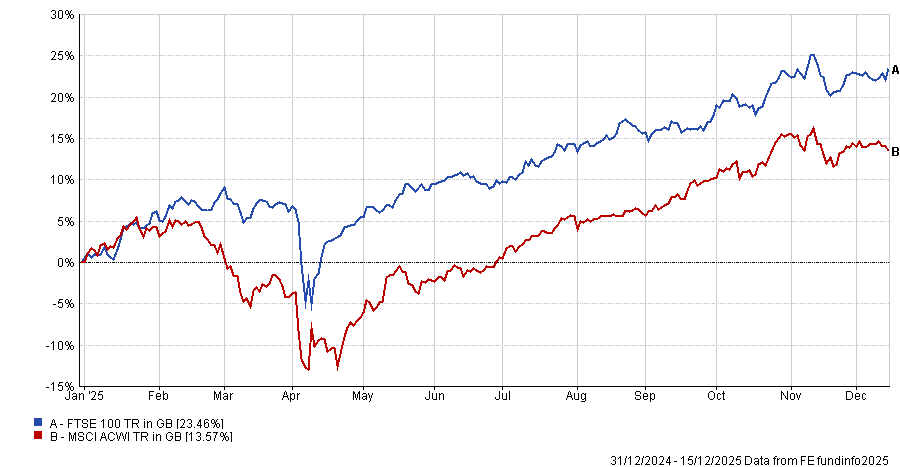

FTSE 100 COULD EXTEND ITS STRONGEST RUN SINCE THE FINANCIAL CRISIS.

The FTSE 100 (the main index of the largest companies on the London Stock Exchange) has had its best year since around 2009, delivering a total return of about 23.5% in 2025, which is much better than the global stock market average. UK shares have beaten big markets like the US and Japan this year, helped by strong company profits and generous cash returns (dividends) to shareholders. Analysts expect FTSE 100 companies’ profits to hit a record of just under £229bn in 2025 and rise another 14% to about £260bn in 2026. The index is no longer “dirt cheap” after the strong run. It trades at around 13.5 times expected 2026 earnings, which is roughly in line with its historical average, so it is described as “not expensive, but not ragingly cheap either”.

Why this matters to you…

Dividends plus buybacks create a “cash yield” of around 5.5%, which currently beats inflation, interest on cash at the Bank of England base rate, and 10‑year UK government bonds, meaning UK shares are paying out a relatively attractive stream of cash to investors.

For a beginner investor using income funds or dividend-focused ETFs, this highlights how a big chunk of long‑term returns can come from income, not just from rising share prices.

What you need to do…

Understand that the total return = price change + dividends, which means that a meaningful part of your return could likely come from dividends and buybacks over time.

When assessing a UK equity fund or ETF, look at the “dividend yield” (how much income it pays).

Dollar close to multi-week lows versus Euro and Yen before US data.

The US dollar has fallen and is trading near its lowest level in several weeks against the euro and the Japanese yen. That simply means one dollar now buys fewer euros and fewer yen than it did a few weeks ago. Traders are waiting for delayed US jobs data (employment figures) and other economic reports that will give clues about how strong or weak the US economy is. These numbers matter because they influence what the US central bank (the Federal Reserve) does with interest rates next year. Market pricing currently suggests a high chance that the Federal Reserve will keep interest rates unchanged at its next meeting. At the same time, other central banks like the Bank of Japan, Bank of England and European Central Bank are also meeting or expected to move rates, which affects their currencies versus the dollar.

Why this matters to you…

If the jobs data show a weaker US economy, markets may expect more interest‑rate cuts in the future, which usually makes the dollar weaker and can support stock and bond prices.

If the data is strong, markets may expect rates to stay higher for longer, which can support the dollar but put pressure on some stocks and “rate‑sensitive” assets (like growth shares or property‑linked investments).

What you need to do…

Focus on the “why”, not just the “what”. Instead of just seeing "Dollar is down," ask "Why is it down?" In this case, it's down because of expectations about the future. Markets move on what they think will happen next, not just what is happening right now.

Use macro articles as education: learn what terms like “jobs data”, “interest‑rate expectations”, “central bank meeting” and “risk‑off” roughly mean, but do not treat them as trading signals.

Thanks for reading this 15th edition.

A show of hands, please - who has already taken their foot off the gas in favour of coasting towards the end of 2025?

For those that raised their hands, shame on you.

For those that didn’t, know that you are my favourite readers.

If this week’s newsletter has taught you nothing else, it’s that there is still much to be decided and much that could still happen in the markets.

What will you do to finish 2025 on a high?